Webinar Events

Maximizing Market Share and Checking Accounts in Today’s Competitive Landscape

Categories:

TUESDAY, 4/30 at 2 pm central (45 min)

Learn how to navigate the challenges and seize the opportunities to grow core deposits and strengthen your competitive position.

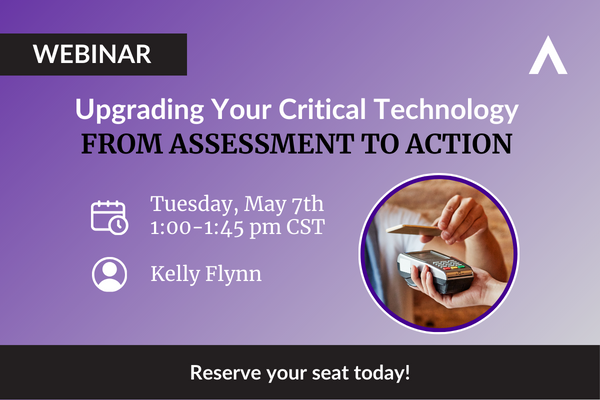

Upgrading Your Critical Technology: From Assessment to Action

Categories:

TUESDAY, 5/7 at 1 pm central (45 min)

Learn best practices for formulating an effective strategy to bolster your financial institution’s digital capabilities and future growth.

Overdraft Overhaul: Insights into the CFPB’s Game-Changing Proposal

Categories:

ON-DEMAND

Presented by Cheryl Lawson, EVP of Compliance Review, learn more about the CFPB’s proposed rule that will potentially impact our industry.

Overdraft Year in Review: Navigating Regulatory Expectations in 2024

Categories:

ON-DEMAND

Presented by Cheryl Lawson, EVP of Compliance Review, learn more about the compliance and regulatory issues surrounding overdraft and non-sufficient funds (NSF) fees.

Driving Deposit Growth Success in 2024

Categories:

ON-DEMAND

Learn how to get an edge in implementing a strategy to reach your deposit growth goals and strengthen your bottom line.

How to Communicate Overdraft Options Successfully

Categories:

ON-DEMAND

Learn tips for empowering your frontline staff to provide effective and consistent communication about your overdraft services. It’s not only critical for protecting reputational risks, but also to improve account holder service.

Overdraft Litigation: Evaluating Your Risk Factors

Categories:

ON-DEMAND

Learn about the latest industry trends in overdraft litigation, ways to reduce consumer complaints, and tips for mitigating risks.

Credit Unions – Keeping Your Overdraft Program Compliant

Categories:

ON-DEMAND WEBINAR

The NCUA has named overdraft programs a supervisory priority—is your credit union prepared? Learn more about how to evaluate your overdraft program and strategy with confidence.

Uncover Hidden Treasure in Your Vendor Contracts

Categories:

ON-DEMAND

Are you looking for ways to find savings that can help support your digital transformation strategy? In this webinar discover tips that will result in significant savings. Plus, we’ll share valuable insights into how you can improve service delivery, reduce consumer friction and improve efficiencies.